Is being a property entrepreneur all it’s cracked up to be?

It’s often said that we’re a nation obsessed by property and, over the last decade, inspired by Location Location Location, we became a nation of property entrepreneurs.

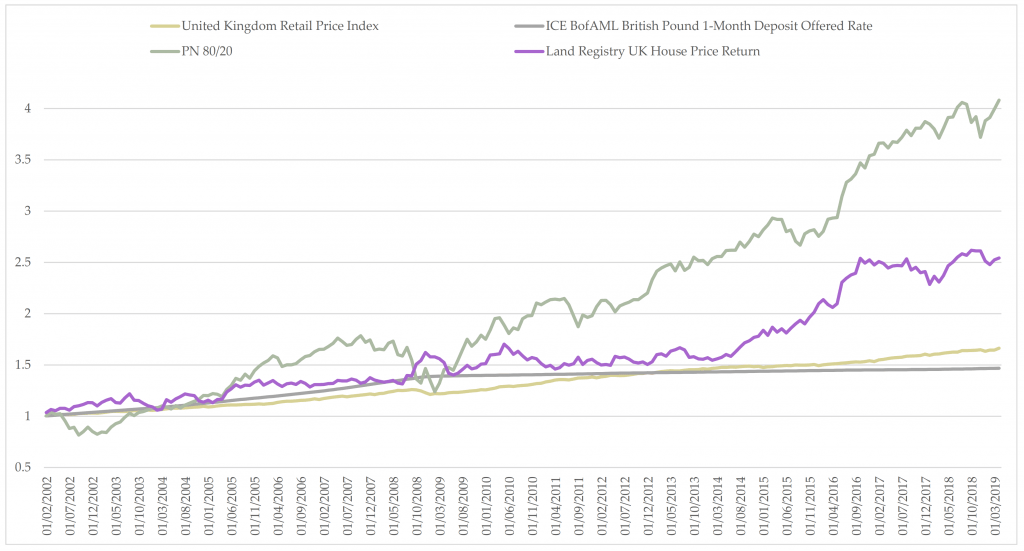

But how successful has our love affair with property been? Actually, the returns look reasonably healthy over twenty years. Taking Halifax monthly house price data, the average house price has increased by 5.37% per annum between February 2002 and April 2019. Add to this a potential rental yield of 2.71%1 and you end up with total return of 8.08%, which isn’t too shabby. However, this figure does not include property management fees, maintenance costs and loan interest (if you borrowed to buy the property). Taking into account all these costs, it is considerably less than might have been achieved from a broadly diversified portfolio over the same period. For instance, our Paradigm Norton 80/20 portfolio increased by 8.52% per annum before fees.

Property vs investment returnsSource: 1https://www.globalpropertyguide.com/Europe/United-Kingdom/rent-yields

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Let’s consider the element of risk

Moreover, the property return was not achieved without risk. From a diversification perspective, an investment property is akin to putting a rather substantial egg in one basket. You can only hope to avoid issues like subsidence or being the unlucky property owner that has to replace the roof. By comparison a Paradigm Norton portfolio contains over 10,000 underlying securities so, for example, when Lehman Brothers went bust you would have had plenty of other holdings to fall back on. There is also liquidity risk to consider: for example, one of my clients sold their investment property to remove unnecessary ‘hassle’ from their life but it took two years for the house to sell. Yet another risk is void rental periods, which is a bigger problem still if there is a mortgage to pay on the property. There are also poorly drafted rental agreements which can have costly consequences and unreliable tenants. I can’t help but mention another unfortunate client who had squatters occupy his property for several years, and the unforeseen complications of getting back possession of the property!

If you would like to speak to a qualified financial planner about this, or any other matter, please give the team a call on 01275 370670. We would love to hear from you.

A second home

Of course, not all clients buy property as an investment decision. For many it is a lifestyle choice, a holiday property being a good example, but that too is not without disadvantages. One example is the loss of freedom to holiday widely and explore new places. There is also a very large opportunity cost of tying up capital in a holiday property that is infrequently used in addition to the increase in stamp duty on the purchase of a second property.

One final thing to remember is that the property return took a great deal of time and effort to capture – you have to run a small business to obtain your 8.08%, keeping accounts, dealing with agents and filing tax returns. Not exactly an example of an uncluttered and simple life, which is what the majority of high-earning, time-poor clients tell us they want.

Investments may fall as well as rise, you may not get back what you put in. This article has been published for educational purposes only and should not be considered investment advice or an offer of any product for sale and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. The Financial Conduct Authority does not regulate some forms of Buy-to-Let. Your home may be repossessed if you do not keep up repayments on your mortgage.